INTRODUCTION

The major football tournaments of last summer, such as EURO 2024 and Copa America, are always landmark events. They capture the attention of millions of football fans and bettors worldwide, becoming the top sports topic across the globe. Naturally, this period is also an important time for the betting industry. Operators strive to meet the heightened user demand, offering both quality service and new opportunities for engagement.

For many years, BETER has been a market leader in providing efootball content, producing over 27,000 in-house events monthly under the ESportsBattle brand in three different formats. This makes it particularly interesting for us to analyze this period from the perspective of efootball betting. By examining data from millions of bets on our efootball tournaments globally, we set out to highlight the key trends and address the most pressing questions:

- How do bettors’ preferences shift when it comes to efootball betting during EURO and Copa America?

- Does efootball content compete with traditional football for users’ attention, or does it complement it?

- How can operators further capitalize on cyber football content, and what are the potential growth opportunities?

KEY METRICS

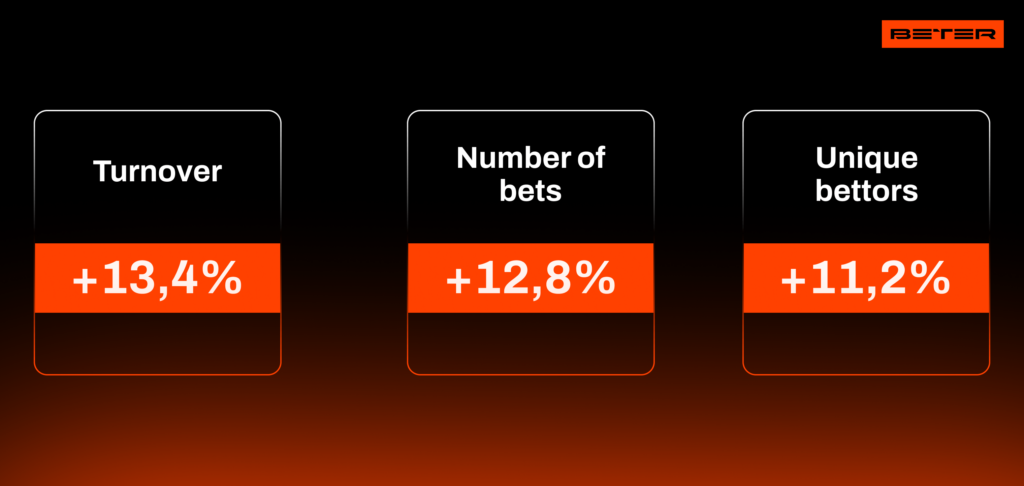

During EURO 2024 and Copa America, bettors displayed heightened interest in efootball events, as reflected by the growth in all key metrics:

At the same time, the margin for efootball content produced by BETER remained consistently high, ensuring strong GGR performance for operators.

KEY TRENDS IN EFOOTBALL BETTING DURING EURO 2024 AND COPA AMERICA

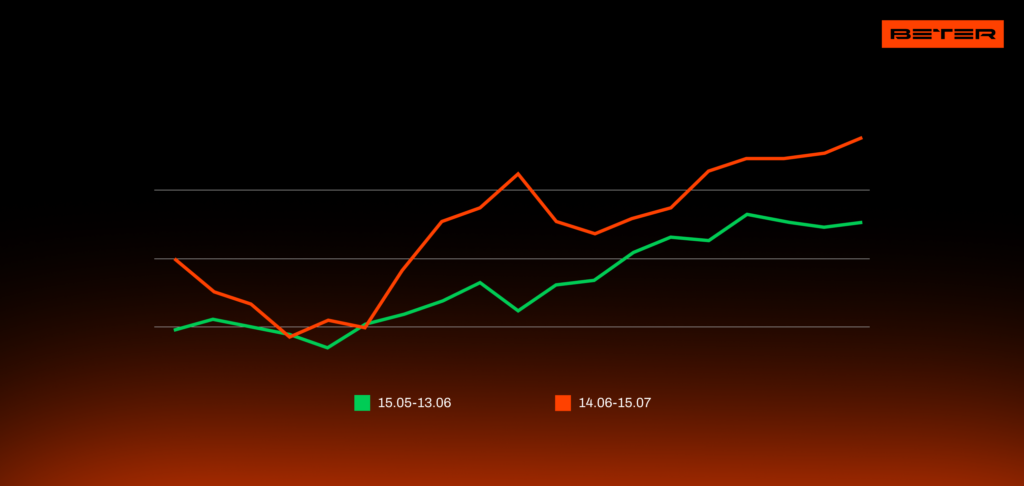

The peak of efootball popularity among bettors occurred immediately following the conclusion of EURO 2024 and Copa America. On July 14, a ‘Super Sunday’ took place, featuring the final matches of both tournaments. On July 15 and 16, the highest betting turnover on efootball was recorded.

Similarly, strong results were observed during the rest of the days of EURO 2024, when no matches were played, as well as on the days of decisive playoff matches, when only 1-2 games were scheduled.

Figure 1. Average turnover per event per day – Comparison

Figure 1. Average turnover per event per day – Comparison

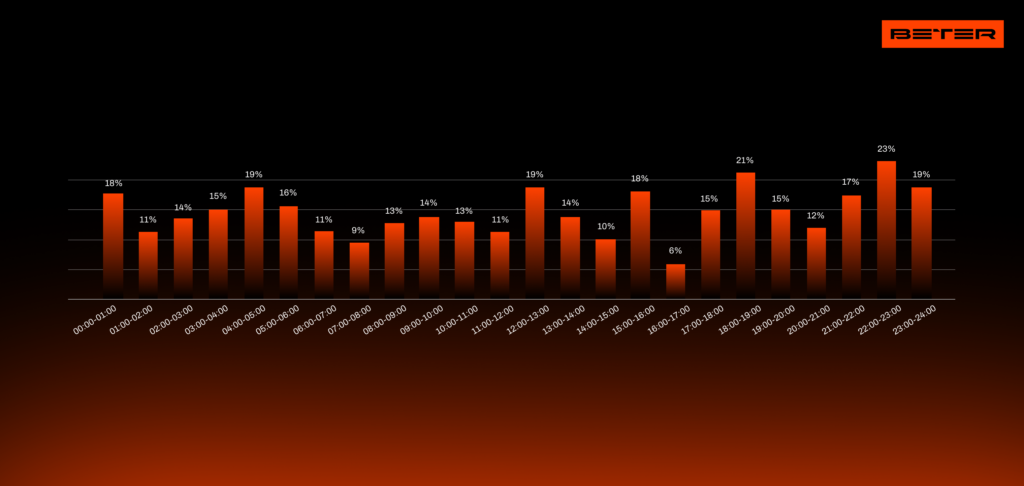

Throughout the day, the number of bets and the average turnover on efootball events increased across all time slots without exception. The most significant growth was observed in the evening, right after the conclusion of the EURO evening matches.

For example, from 10 to 11 p.m., the average turnover increased by a substantial 23% and remained high in the following hours.

A separate peak was also noticeable at night, following the end of the Copa America matchday. Thus, esoccer served as an alternative for bettors when their interest in EURO matches naturally waned.

Figure 2. Turnover growth by time slots during Euro 2024 and Copa America

Figure 2. Turnover growth by time slots during Euro 2024 and Copa America

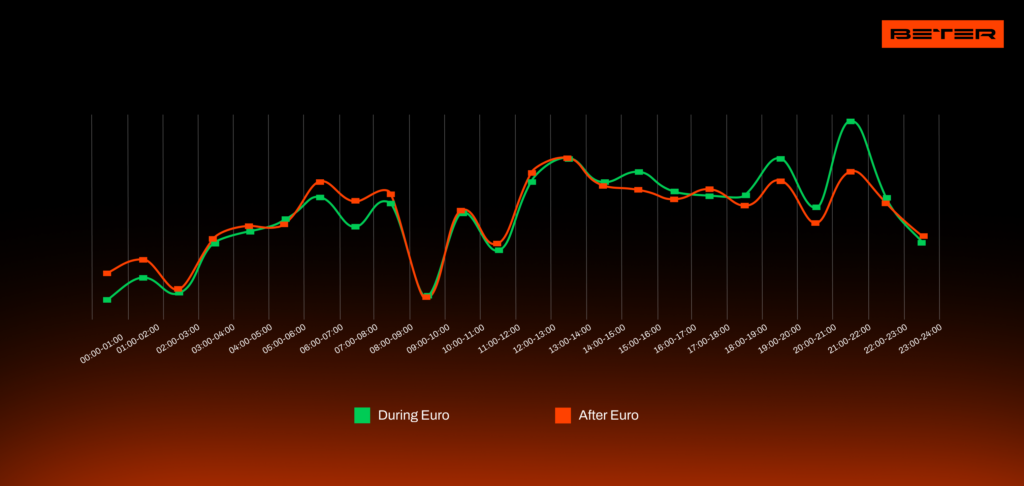

An important feature of betting on efootball is its consistent level of interest throughout the day. Despite the fluctuations in bettors activity described above, efootball maintains a relatively even level of engagement during all 24 hours. Typically, the difference between the peak and the least active hours in terms of bettor engagement is no more than a factor of two.

During major tournaments, due to the significant increase in bettor activity in the evening, the difference between the most and least active time slots widens. However, the overall trend remains unchanged — efootball fans continue to stay engaged throughout the day, and operators enjoy stable and predictable turnover 24/7.

Figure 3. Сhange in the share of time slots in daily turnover compared to the same period after EURO and Copa America (UTC+0)

Figure 3. Сhange in the share of time slots in daily turnover compared to the same period after EURO and Copa America (UTC+0)

As previously noted by colleagues at Abios, a significant overlap exists between audiences interested in football and those interested in efootball.

Given the bettor behavior patterns and the significant overlap between football and efootball audiences, it’s clear that efootball has the potential to be a powerful tool for engaging the football audience.

This is especially relevant during periods of heightened football interest — both during and immediately after major football events — when the volume of football bets typically declines, yet the audience remains engaged and eager for continued action.

Operators incorporating this insight into their marketing and content strategies can gain additional benefits and better monetize esoccer content.

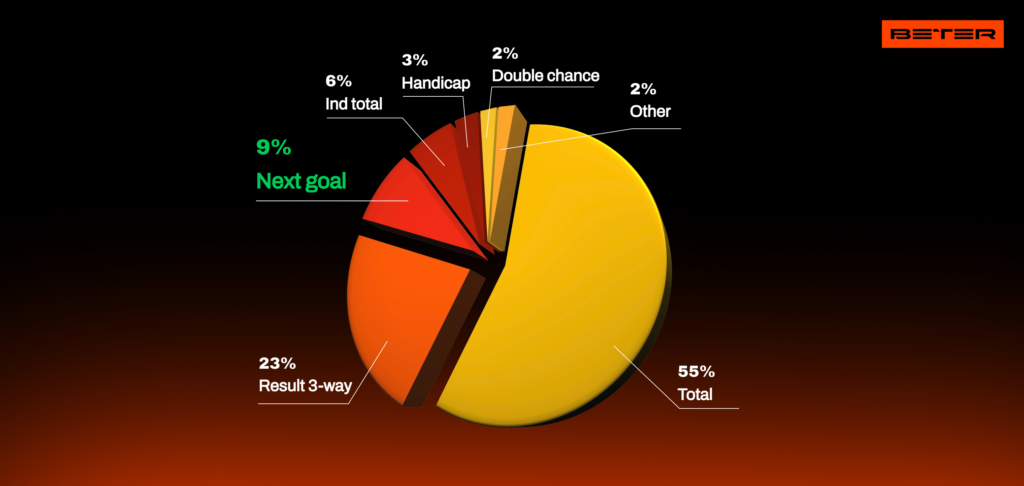

MOST POPULAR MARKETS BY TURNOVER

Overall, the structure of bets on efootball remained largely unchanged during EURO, with more than half of all bets traditionally placed on Totals.

An interesting exception was the ‘next goal’ market: the volume of bets on this market increased by more than 20%.

This growth is understandable. With bettors highly engaged in the game due to EURO, they also seek additional opportunities for quick bets. Esoccer provides such opportunities, and the ‘next goal’ market is one of the simplest and most straightforward options for rapid betting, with the time between placing a bet and settling it ranging from several seconds to a few minutes.

Figure 4. Efootball markets shared by turnover during Euro 2024 and Copa America

Figure 4. Efootball markets shared by turnover during Euro 2024 and Copa America

MOST POPULAR EFOOTBALL TEAMS

*Change in team popularity ranking by average turnover per match during EURO 2024 and Copa America

*Change in team popularity ranking by average turnover per match during EURO 2024 and Copa America

PERFORMANCE ACROSS VARIOUS EFOOTBALL FORMATS

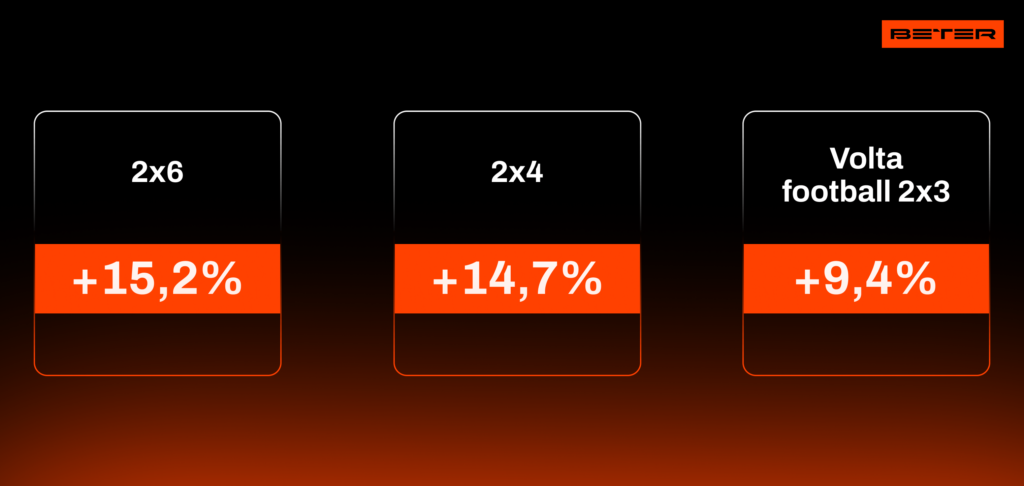

BETER’s product portfolio includes 3 formats of efootball matches: from the fast-paced and spectacular Volta Football (with a total match duration of 6 minutes) to the more traditional betting formats of 2×4 and 2×6 minutes.

During the period we analyzed, the 2×4 format remained the most in-demand and popular among bettors, with the average turnover on its matches increasing by nearly 15%. Nevertheless, the 2×6 format showed an even more impressive growth in both the number of bets and turnover.

Average turnover on match

Average turnover on match

ABOUT BETER AND OUR EFOOTBALL OFFERING

BETER is a leading provider of content, data, and betting solutions for the iGaming industry and the market leader in efootball content. We have been developing efootball tournaments under the ESportsBattle brand since 2018.

- 24/7 efootball coverage

- 27,000+ monthly events

- 100 efootball players

- 3 different countries

- 3 gaming formats

Contact our team to learn more about the synergy between global football tournaments and efootball events of ESportsBattle: [email protected]